working capital funding strategies

6 Strategies for funding working capital. Aggressive conservative and matching.

See All Posts by SR Working Capital Strategy 2010 Related Filed Under Passion is inversely proportional to the amount of real information.

. This source of startup funding cannot be termed as debt or equity since it is just your own customers paying you in advance. Make use of a cash flow budget. Working capital Strategies 1.

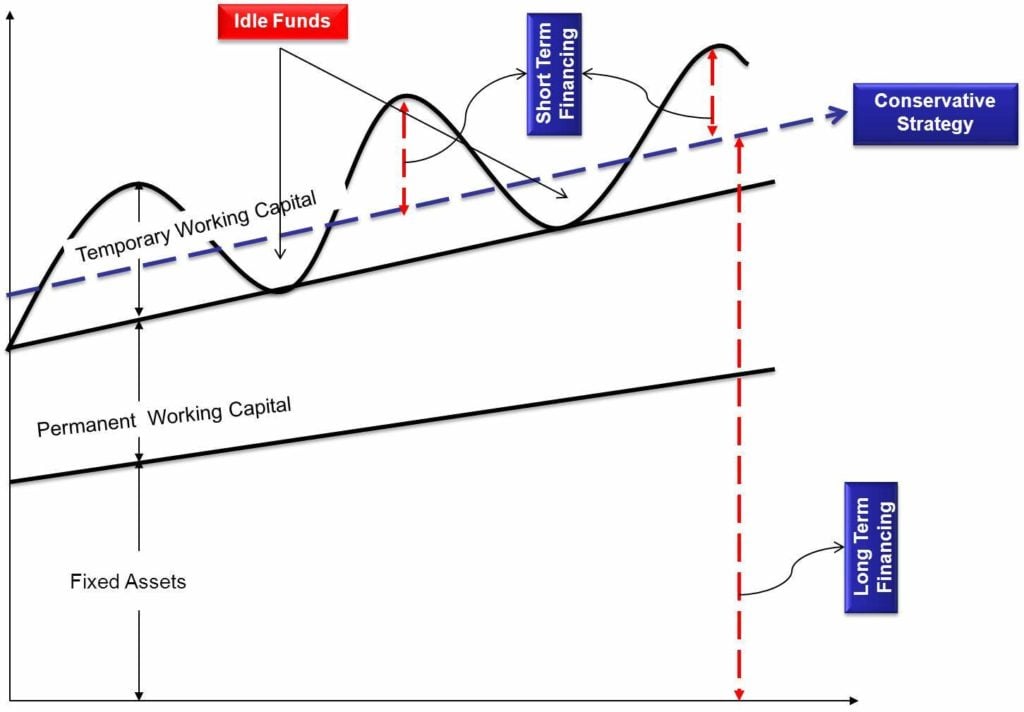

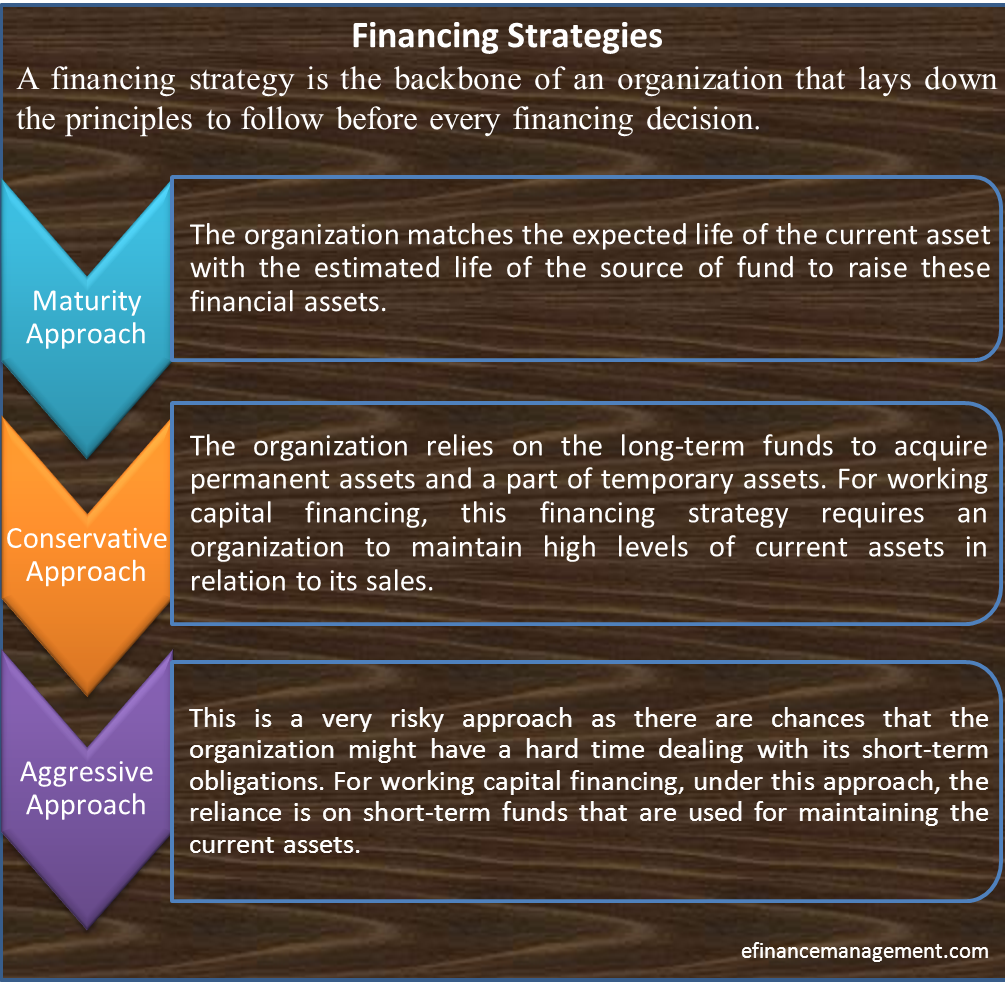

Create efficiencies that will help to complete jobs and tasks faster. Launch a crowdfunding campaign. There are broadly 3 working capital management strategies approaches to choosing the mix of long and short-term funds for financing the net working capital of a firm viz.

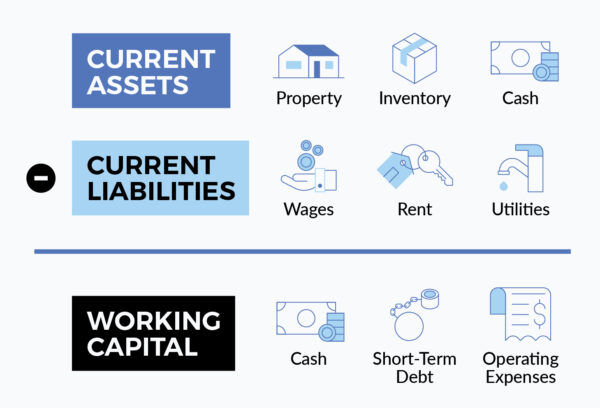

Efficient working capital management helps maintain smooth operations and can also help to improve the companys earnings and profitability. Here the temporary working capital will be funded by short term finances such as trade credit short term loan. Its commonly defined as current assets minus current liabilities.

Your working capital position can always be improved by earning higher profits issuing company stock taking on more debt and selling assets for cash. Conservative aggressive hedging or maturity matching approach. If your business is in its first year of operation and has not yet become profitable then you might have to rely on equity funds for short-term working capital needs.

6 strategies for funding working capital. The remaining portion of the. Even companies in the same industry will have different levels of inventory and receivables due to their differing policies.

The amount of operating working capital needed by a business depends primarily on its level of sales revenue. Usually working capital is calculated based on cash. Therefore the goal of working capital management is to manage a business current assets and current liabilities in such a way so that a satisfactory level of working capital is maintained.

The following points highlight the top approaches of working capital management strategies. Whether adopting a conservative hedging or aggressive working capital. The lax strategy blue line will have an average working capital of 48M with a standard deviation of.

Working capital financing involves improving cash flow to allow for business opportunities. Where the aggressive strategy is concerned long-term funds are used to finance fixed assets and part of the permanent working capital. You can finish your back deck quickly and at high quality but it will cost more.

I the distinction between permanent and fluctuating current assets ii the relative. The annual rel1 cfo working capital survey made its debut in 1997 in the cfo magazine. The effects for the amount of working capital are shown in the graph below.

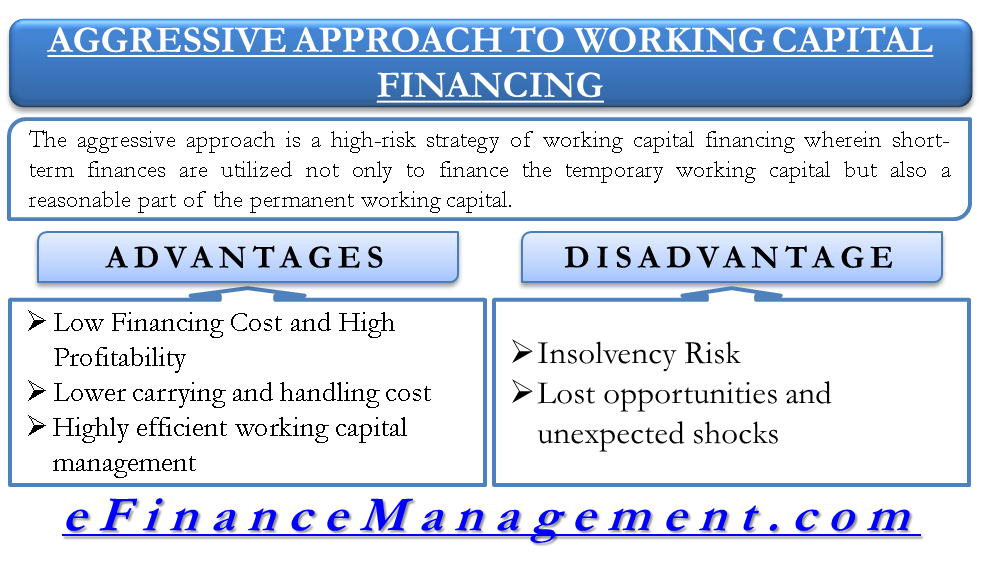

Make concerted efforts to always optimize your working capital. 111 Permanent or fluctuating current assets. An aggressive policy uses lower levels.

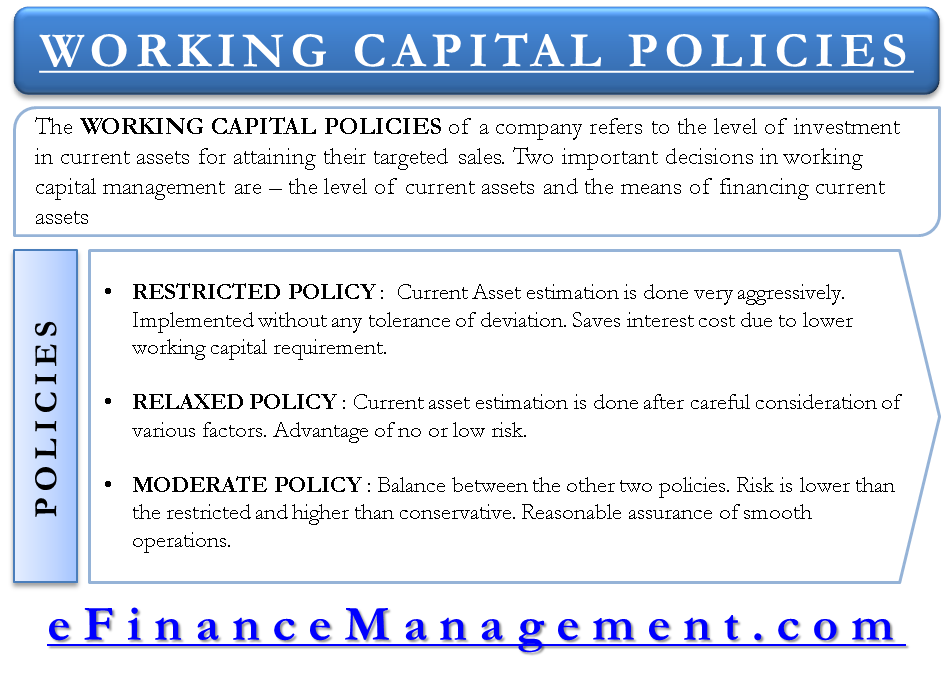

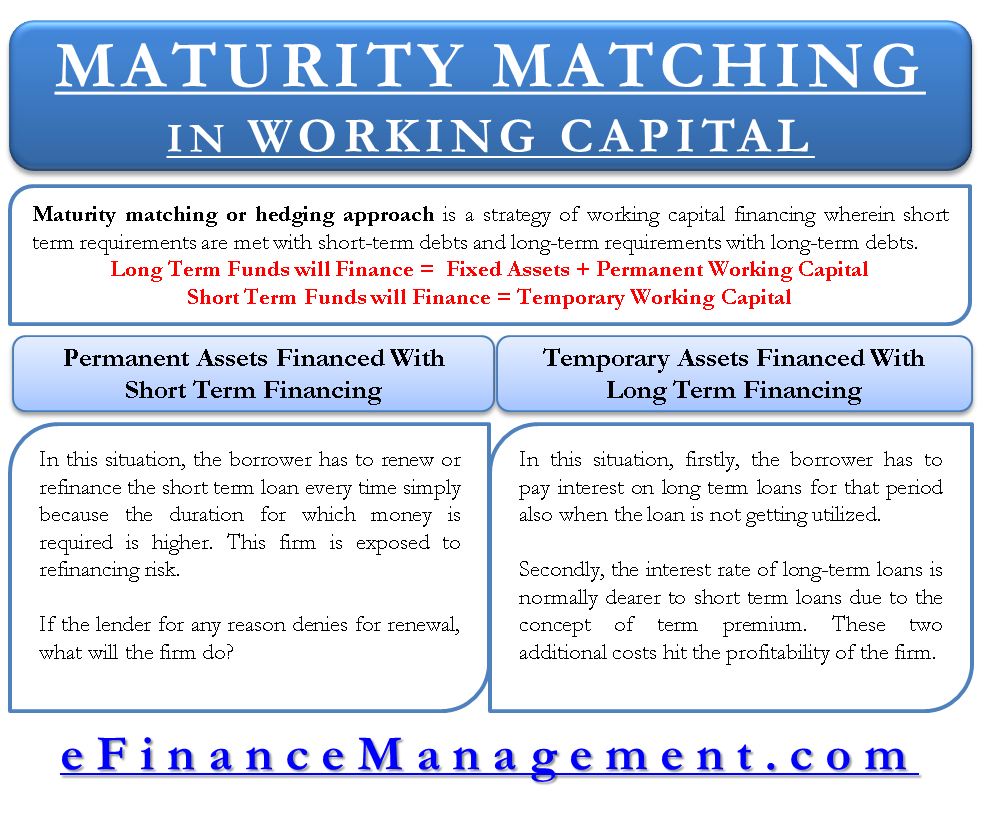

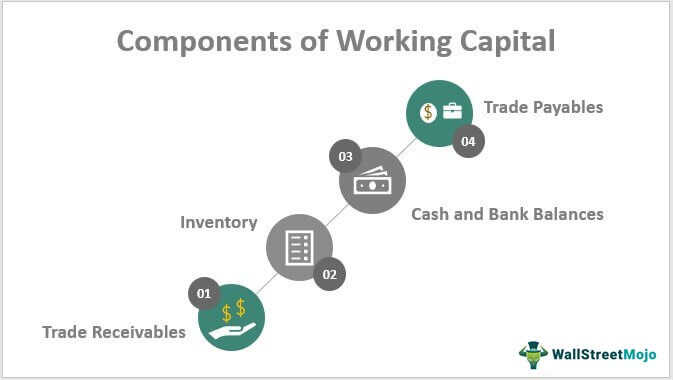

B Describe and discuss the key factors in determining working capital funding strategies including. Working capital management -Cash and funding strategies - Free ACCA CIMA online courses from OpenTuition Free Notes Lectures Tests and Forums for ACCA. The hedging approach is an ideal.

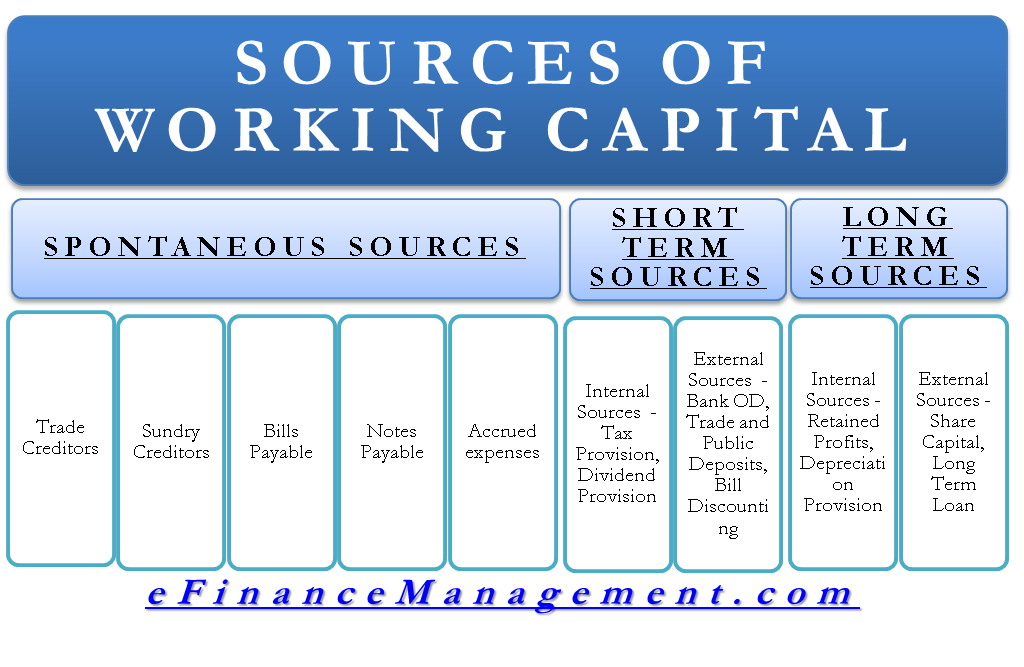

The 3 Types of Working Capital Funding Strategies. There are three strategies or approaches or methods of working capital financing Maturity Matching Hedging Conservative and Aggressive. Working Capital Funding Strategies.

112 The attitude of management to risk. In the same way as for long-term investments a firm must make a decision about what source of finance is best used for the funding of working. 13 Elements of working capital.

A conservative strategy suggests not to take any risk in working capital management and to carry high levels of current assets in. In general working capital policies involve determining the sources of finance. Working capital is the amount of cash a business can safely spend.

Management of working capital. Ad Consultation pour entreprises Services daffaires internationales. In order to fund its working capital requirement a business needs to decide on its attitude to risk and reward and establish its working capital financing strategy.

Working capital management refers to the set of activities performed by a company to make sure it got enough resources for day-to-day operating expenses Operating Expenses Operating. It also determines the allocation of these finances towards current assets and liabilities. Working Capital Financing Strategy.

Price quality or time. When considering a home renovation and shopping for contractors the age-old advice is to pick two.

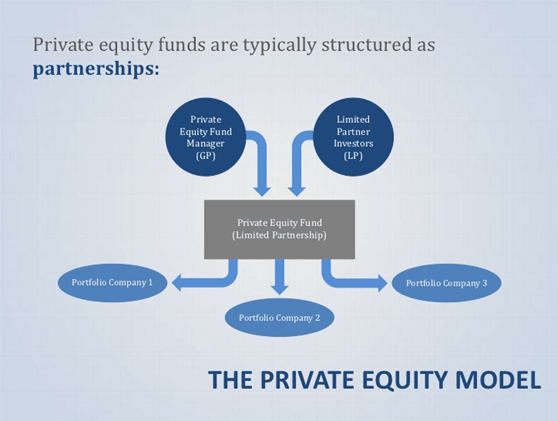

Career Guide To Private Equity Jobs What You Need To Know

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital Policy Relaxed Restricted And Moderate

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital What Is It And Why Do You Need It Business 2 Community

Working Capital Cycle Understanding The Working Capital Cycle

Working Capital Management Conservative Approach Efm

Working Capital Types Of Working Capital Learn Accounting Finance Types Of Work

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Aggressive Approach To Working Capital Financing Management Efm

Maturity Matching Or Hedging Approach Rationale Pros Cons Example

Financing Strategies Matching Conservative Aggressive Approach

What Are The Approaches To Working Capital Management Enterslice

Working Capital Management Conservative Approach Efm

Components Of Working Capital Top 4 Detailed Explained

Working Capital What Is It And Why Do You Need It Business 2 Community

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)